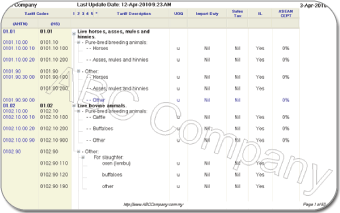

FREE TRADE AREA (FTA)

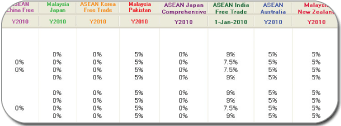

A preferential tariff rate is extended to partner countries who have signed Free Trade Agreements (FTA) with each other. This means that customs duties for selected imported goods that originate from the FTA partner countries are lower or totally eliminated. There will be lower or zero tariffs for exports from FTA partner countries to Malaysia that satisfy the necessary rules of origin and are given preferential tariff treatment by the importing country. Tariff Finder includes complete preferential tariff rate for:

ASEAN Free Trade Agreement (AFTA)

ASEAN China Free Trade Agreement (ACFTA)

Malaysia Pakistan Closer Economic Partnership (MPCEPA)

Malaysia Japan Economic Partnership (MJEPA)

ASEAN Korea Free Trade Agreement (AKFTA)

ASEAN Japan Comprehensive Economic Partnership (AJCEP)

ASEAN Australia New Zealand Free Trade Agreement (AANZFTA)

Malaysia New Zealand Free Trade Agreement (MNZFTA)

ASEAN India Free Trade Agreement (AIFTA)

Free Trade Area (FTA) = Lower Duty or Duty FreeCUSTOMS LAW & REGULATIONS

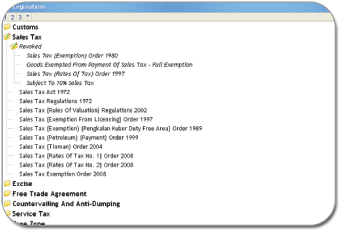

In some circumstances, there is a need to refer to Customs Laws & Regulations. Up-to-date Legislations related to Customs Act, Excise Act, Sales Tax Act, Service Tax Act, Free Zone Act, Levy Act, Free Trade Agreements and others are available within Tariff Finder. The documents are searchable, translatable, printable and can be copied and pasted onto any Windows application.

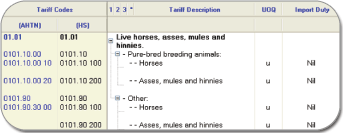

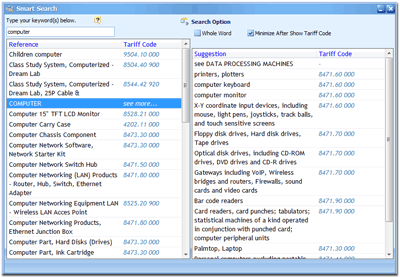

SMART SEARCH

Experience and intensive knowledge is needed in order to search for tariff codes or classifications. A majority of commodities do not have direct indication of the commodities name in the Tariff Description. For example, if you are looking for the word “car”, the Tariff Description uses the term “vehicle”. The tariff description of “computer” is “data processing machine”, and “dvd player” falls under the description “others”. This makes the search process tricky. Tariff Finder is built in with an intelligent feature known as the Smart Search, allowing you to search by using layman keywords.

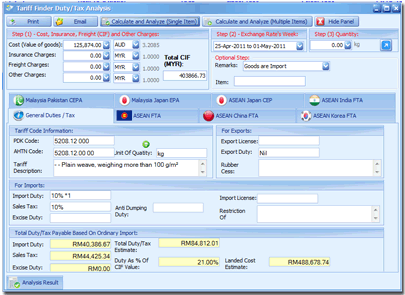

MULTIPLE ITEMS DUTY CALCULATION & ANALYSIS

Duties are important as it affects the cost of goods. Tariff Finder provides calculations as well as analysis for the landed cost estimate. Customs weekly exchange rate is updatable via Live Update. Knowledge of Free Trade Area is very important as it allows you to enjoy lower tariff or duty free on the goods. Tariff Finder calculates and comes up with various duties options subject to all the FTAs. Tariff Finder sorts out the total duties from lowest to highest duties.Why pay more duties? Remember, your profit margin depends on you.

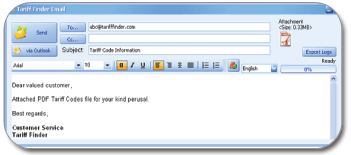

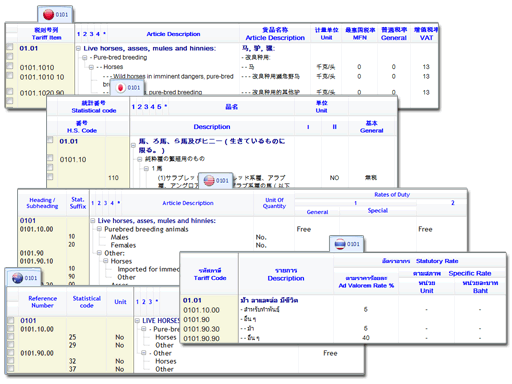

WORLDWIDE TARIFF CODE INFORMATION

Tariff Finder is not valued by your invested money, but as a rich source of information and direction. More information equals more power and value. Simplify, simplify. We make innovation our business. We simplify world tariff code finding. Our vision is to have every country’s tariff code, in any language, all integrated in Tariff Finder.Currently, Tariff Finder includes tariff information for:

Australia

Australia China

China Japan

Japan Malaysia

Malaysia Nigeria

Nigeria Thailand

Thailand USA

USA

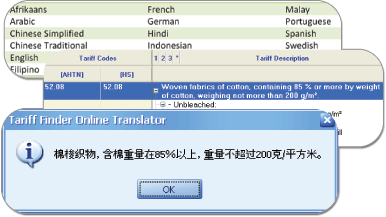

STATE-OF-THE-ART LANGUAGE TRANSLATOR

Tariff Finder’s translation is produced by state-of-the-art technology, without the intervention of human translators or known as automatic translation. Automatic translation is very difficult, as the meaning of words depends on the context in which they are used. In the interim, we hope you find this service useful for most purposes.Currently, Tariff Finder supports translation language :

- Afrikaans

- Arabic

- Chinese Simplified

- Chinese Traditional

- English

- Filipino

- French

- German

- Hindi

- Indonesian

- Japanese

- Korean

- Malay

- Portuguese

- Spanish

- Swedish

- Thai

- Vietnamese

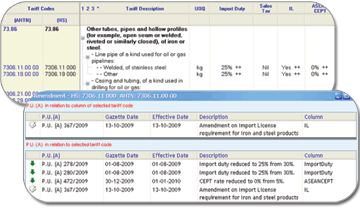

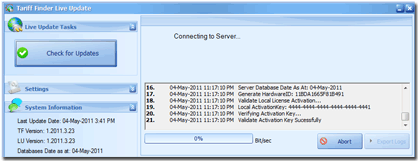

LIVE UPDATE

Tariff Finder emphasizes on Up-To-Date and Accurate information.

Most people have the notion that customs amendments only happen once or twice during the year, such as during Budget Day. The fact is there is at least one amendment per month. So, how to keep up with all the frequent amendments?

Besides the existing Free Trade Area like AFTA, ASEAN China FTA, more and more FTAs will be implemented. With the preferential tariff, importers and exporters can now enjoy lower duty or duty free. It is indeed good news provided you update yourself with the information as and when it is made available.

In year 2012, there will be major amendments to the structure of HS tariff code worldwide including Malaysia. The whole structure will be revamped. The exercise happens once every 4 to 5 years. It means that, all tariff references will be obsolete. There will be additional tariff codes. Existing tariff codes might be removed or replaced.,br.,br.With all the happenings, are you well equipped for the updates? Bear in mind that knowledge of the latest amendments, FTAs or information affects your profit margin. Tariff Finder is built in with Live Update feature. Whenever there are amendments, a notification will be sent to you through email or SMS.

How soon can you obtain the latest amendment? The commitment is within the same day of the amendment effective date.

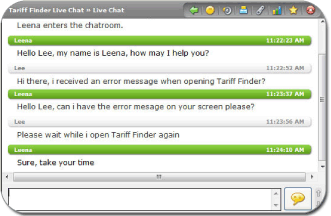

ONLINE REMOTE SUPPORT

TARIFF FINDER PORTABLE

Now you can take Tariff Finder with you. Carry and access Tariff Finder on any PC* without installation or activation. Just plug the drive into the USB port and the world of Tariff is with you!

Imagine carrying Tariff Finder software on the same USB drive that carries your files. That’s what you can do with a Tariff Finder The World Edition – Portable smart drive. You can plug it into any PC* and work, find tariff code, calculate duty, save bookmarks, print tariff codes and more. A Tariff Finder The World Edition – Portable smart drive makes any PC your own PC. And when you unplug it, it leaves no personal data behind.

* Support Windows 7, Vista, XP, & 2000